Vitalik Buterin said public companies that buy and hold Ether broaden the token’s access to a wider range of investors, but cautioned on leveraging too heavily.

Ethereum co-founder Vitalik Buterin threw his support behind Ether

ETH$3,893 treasury companies, but warned that the trend could spiral into an “overleveraged game” if not handled responsibly.

In an interview with the Bankless podcast released on Thursday, Buterin said the growing number of public companies buying and holding Ether was valuable because it exposes the token to a broader range of investors.

“There’s definitely valuable services that are being provided there,” Buterin said. He added that companies buying into ETH treasury firms instead of holding the token directly gives people “more options,” especially those with “different financial circumstances.”

Leverage must not lead to ETH’s “downfall”

Buterin tempered his support with caution, stressing that ETH’s future must not come at the cost of excessive leverage.

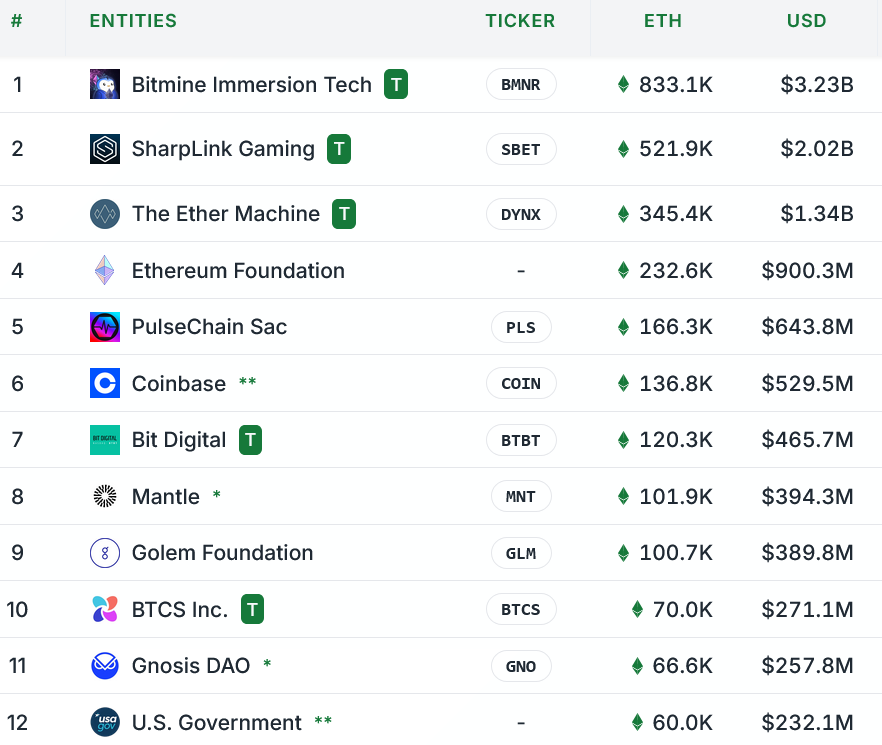

ETH treasury firms now hold nearly $12 billion

The market for public companies that hold Ether has ballooned to $11.77 billion, led by BitMine Immersion Technologies and SharpLink Gaming.

BitMine holds 833,100 ETH worth $3.2 billion — the fourth-largest holdings among public companies that hold any cryptocurrency.

Related: Ethereum beats Solana in capital inflows: $4K target in sight

SharpLink and The Ether Machine hold $2 billion and $1.34 billion worth of ETH, respectively, while the Ethereum Foundation and PulseChain round out the top five.

ETH making a comeback

ETH has seen a mixed year so far, falling from around $3,685 in January to a low of $1,470 on April 9, before rallying more than 163% to its current price of $3,870.

The trend of ETH treasury firms has been a notable catalyst behind the token’s resurgence. Its price rally has helped ETH close the gap on Bitcoin and Solana