Shares of US crypto companies fell sharply on Friday amid a broader sell-off in risk assets, driven by disappointing economic data and renewed tariff threats.

Shares of Coinbase (COIN), Riot Platforms (RIOT) and CleanSpark (CLSK) dropped between 7% and 16% in Friday trading. The declines mirrored broader market weakness, with the Dow Jones Industrial Average losing over 600 points, the S&P 500 falling 1.6% and the Nasdaq Composite down more than 2% in early trading.

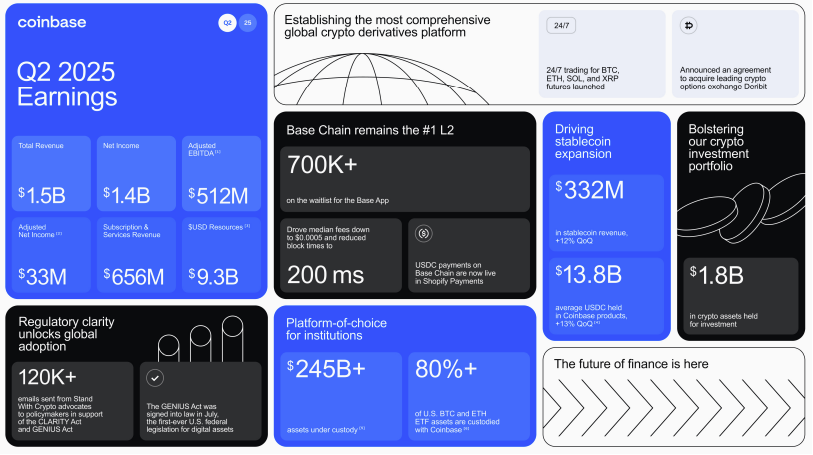

Coinbase’s losses extended a sell-off that began after hours on Thursday, following the company’s disappointing quarterly results. The crypto exchange reported $1.5 billion in revenue for the second quarter, but transaction volumes fell, weighing on results.

While headline net income was $1.4 billion, excluding investment gains, net income was just $33 million.

Riot Platforms also slumped, despite reporting strong Q2 results. The crypto miner more than doubled its revenue to $153 million, including $85.1 million from Bitcoin

mining. Earnings per share came in at $0.98, far exceeding expectations for a $0.21 loss.

One app, all things crypto — buy, trade, earn, and manage it all with Uphold. Capital at risk. Terms Apply.Ad

CleanSpark’s decline appeared unrelated to company-specific developments and instead followed the broader market trend. The company last reported earnings in May, showing a 62.5% year-over-year increase in revenue for its fiscal second quarter.

Crypto stocks declined sharply as Bitcoin and the broader digital asset market pulled back. Since these stocks are often viewed as leveraged bets on Bitcoin’s price, their losses were amplified by BTC’s recent pullback.

Bitcoin fell below $115,000 on Friday, down from highs near $120,000 earlier in the week.

Related: Despite record high, S&P 500 is down in Bitcoin terms

Nonfarm payrolls slowdown signals economic weakness

Investors’ appetite for risk assets soured following the latest US nonfarm payrolls report, which showed a sharp slowdown in hiring. The Bureau of Labor Statistics reported just 73,000 jobs created last month, well below the 100,000 gain expected by economists surveyed by Dow Jones.

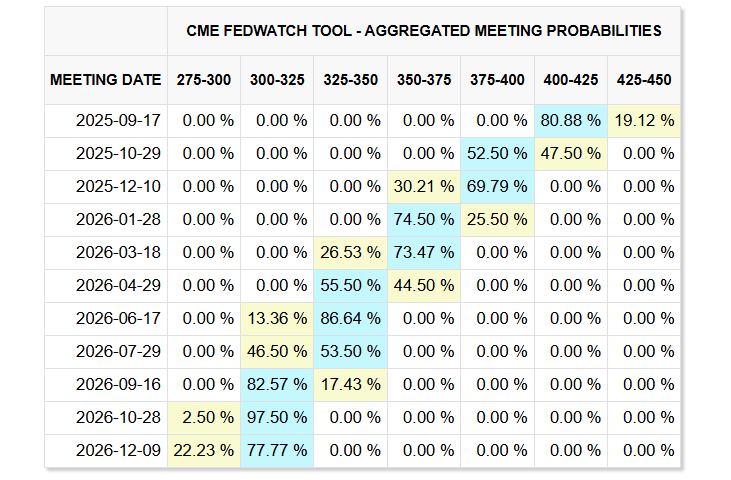

The weaker-than-expected data reignited expectations for more aggressive rate cuts this fall, with CME Group’s FedWatch Tool now pricing in an 80% chance of a September cut.

However, one major obstacle remains: persistent inflation. The Federal Reserve’s preferred inflation gauge — core PCE — came in hotter than expected for June, complicating the case for near-term policy easing.

Meanwhile, US President Donald Trump has reignited trade war concerns after the White House published revised tariff rates ranging from 10% to 41% ahead of the Aug. 1 trade agreement deadline. As part of the changes, the administration imposed 40% tariffs on goods rerouted to bypass existing duties.

“While investors have been viewing the commencement of the Fed cutting cycle as a positive catalyst for risk assets, today’s release is best characterized as ‘bad news is bad news’ in our view,” said Jeffrey Schulze of ClearBridge Investments, referring to the nonfarm payrolls report.

Schulze added that the combination of already weak job growth and rising tariffs could cause the labor market to contract in the coming months.

Magazine: China mocks US crypto policies, Telegram’s new dark markets: Asia Express

Explore more articles like this

Subscribe to our Crypto Biz newsletter

Weekly snapshot of key business trends in blockchain and crypto, from startup buzz to regulatory shifts. Gain valuable insights to navigate the market and spot financial opportunities. Delivered every Thursday

Subscribe

By subscribing, you agree to ourTerms of Services and Privacy Policy

Disclaimer. Cointelegraph does not endorse any content or product on this page. While we aim at providing you with all important information that we could obtain in this sponsored article, readers should do their own research before taking any actions related to the company and carry full responsibility for their decisions, nor can this article be considered as investment advice.

Read more

- Nvidia releases update for ‘critical’ vulnerabilities in AI stack

- adPerpetual DEX aims to solve the core problems of onchain trading — Here’s how

- Price predictions 8/4: SPX, DXY, BTC, ETH, XRP, BNB, SOL, DOGE, ADA, XLM

Aug 01, 2025

UK regulator lifts ban on crypto ETNs for retail investors

After banning retail access to crypto ETNs and derivatives in 2021, the FCA has reversed its approach in favor of ETN access for retail.Listen3:53

28423

News

COINTELEGRAPH IN YOUR SOCIAL FEED

The United Kingdom’s Financial Conduct Authority (FCA) has lifted the ban on retail access to cryptocurrency exchange-traded notes (cETNs).

Companies in the UK will soon be able to offer retail consumers cETNs, with regulatory changes effective Oct. 8, according to an FCA announcement on Friday.

The new development in the UK’s regulatory approach on crypto comes after the FCA banned crypto ETNs in January 2021, citing the extreme volatility of crypto assets and a “lack of legitimate investment need” for retail consumers.

“Since we restricted retail access to cETNs, the market has evolved, and products have become more mainstream and better understood,” David Geale, FCA executive director of payments and digital finance, said in the announcement.

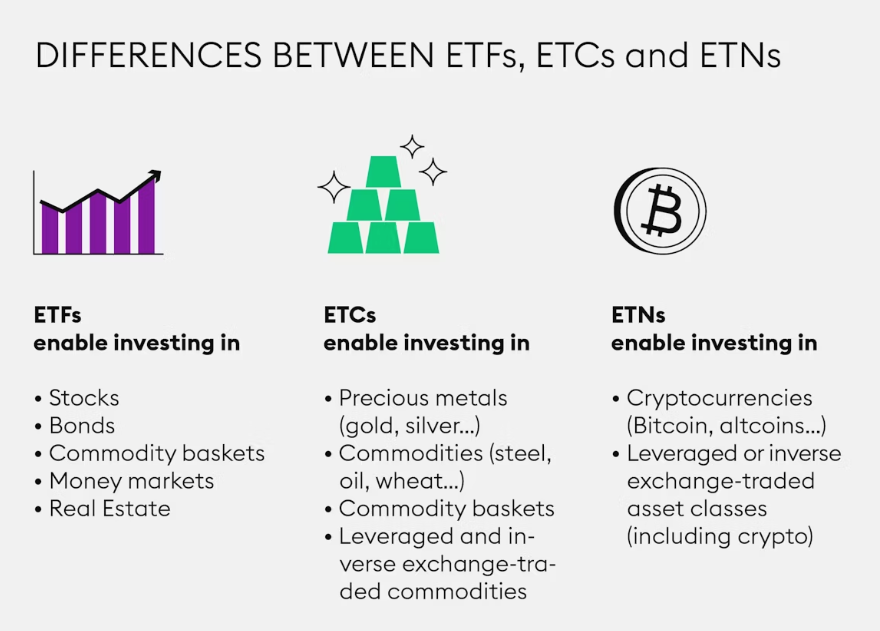

What are crypto ETNs?

Unlike cryptocurrency exchange-traded funds (ETFs), which track the price of underlying assets like Bitcoin

in custody, crypto ETNs are not backed by any underlying assets and represent debt securities.

“Instead of equity in the fund, each traded note of an ETN represents an obligation from a legal entity holding the underlying asset as collateral,” according to the ETN description by the Austrian crypto trading platform Bitpanda.

By investing through an ETN tracking crypto, investors can obtain exposure to physical crypto assets via their regular brokers or banks.

ETNs are associated with risks like limited control over their assets, which underscores the importance of purchasing ETNs from reputable institutions to ensure safety, Bitpanda said.

Crypto derivatives still banned

While allowing crypto ETNs, the UK FCA is yet to make a decision on whether to allow retail investors to access crypto derivatives, which the authority banned alongside ETNs in 2021.

“The FCA will continue to monitor market developments and consider its approach to high-risk investments,” the regulator stated.

Related: ‘Everything is fine’: Coinbase mocks UK financial system in new video

Crypto derivatives, or products such as crypto futures, options and perpetual contracts, have shown resilience in the second quarter of 2025, with volumes netting $20.2 trillion, according to the crypto analytics platform TokenInsight.

In contrast, centralized exchanges’ (CEXs) volumes plummeted by 22%, showing a big contrast to cryptocurrency ETFs.

US allows in-kind for crypto ETFs: No impact on retail

Cryptocurrency ETFs have seen remarkable growth since their historic launch in the US in 2024, with issuers like BlackRock posting a 370% surge in inflows in Q2 2025 and crypto funds breaking multiple records.

On Tuesday, the US Securities and Exchange Commission (SEC) delivered another crucial decision on crypto ETFs, authorizing issuers to proceed with in-kind creations and redemptions or to exchange ETF shares for the underlying crypto assets.

Although the move is largely seen as big news for the crypto industry, ETF analysts like Eric Balchunas say that the event will likely have little to no impact on retail investors.

“It’s not a huge impact to retail but more of a plumbing fix. It just makes the pipes a little better,” Balchunas said in an X post on Tuesday. The biggest takeaway from the milestones is that the SEC is ready to treat crypto like a legit asset class, he added.

https://www.buzzsprout.com/2040516/episodes/17449139-crossing-the-crypto-divide-the-west-s-race-for-digital-dominance?client_source=small_player&iframe=true&referrer=https://www.buzzsprout.com/2040516/17449139.js?container_id=buzzsprout-player-2040516-17449139&player=small

Magazine: Crypto traders ‘fool themselves’ with price predictions: Peter Brandt

Explore more articles like this

Subscribe to the Markets Outlook newsletter

Get critical insights to spot investment opportunities, mitigate risks, and refine your trading strategies. Delivered every Monday

Subscribe

By subscribing, you agree to ourTerms of Services and Privacy Policy

Read more

- Here’s what happened in crypto today

- adTelegram bot brings speed, analytics and streamlined onchain trading

- Price predictions 8/4: SPX, DXY, BTC, ETH, XRP, BNB, SOL, DOGE, ADA, XLM

Aug 02, 2025

Ramping up efforts around PayFi: AMA recap with Tron

With gas-free USDT transfers, deep exchange integrations and over $600B in monthly stablecoin volume, the blockchain powers real-world adoption.Listen5:55

13160

Recap

Tron, a layer-1 blockchain network, has intensified its efforts to become a core infrastructure layer for stablecoin settlement, focusing on deep technical development and real-world utility.

In a recent AMA hosted by Cointelegraph, Sam Elfarra, community spokesperson at Tron DAO, outlined the factors contributing to the network’s adoption, the technical implications of enabling gas-free USDT transfers and the role of Tron as the backbone of global crypto payments.

https://platform.twitter.com/embed/Tweet.html?creatorScreenName=cointelegraph&dnt=false&embedId=twitter-widget-0&features=eyJ0ZndfdGltZWxpbmVfbGlzdCI6eyJidWNrZXQiOltdLCJ2ZXJzaW9uIjpudWxsfSwidGZ3X2ZvbGxvd2VyX2NvdW50X3N1bnNldCI6eyJidWNrZXQiOnRydWUsInZlcnNpb24iOm51bGx9LCJ0ZndfdHdlZXRfZWRpdF9iYWNrZW5kIjp7ImJ1Y2tldCI6Im9uIiwidmVyc2lvbiI6bnVsbH0sInRmd19yZWZzcmNfc2Vzc2lvbiI6eyJidWNrZXQiOiJvbiIsInZlcnNpb24iOm51bGx9LCJ0ZndfZm9zbnJfc29mdF9pbnRlcnZlbnRpb25zX2VuYWJsZWQiOnsiYnVja2V0Ijoib24iLCJ2ZXJzaW9uIjpudWxsfSwidGZ3X21peGVkX21lZGlhXzE1ODk3Ijp7ImJ1Y2tldCI6InRyZWF0bWVudCIsInZlcnNpb24iOm51bGx9LCJ0ZndfZXhwZXJpbWVudHNfY29va2llX2V4cGlyYXRpb24iOnsiYnVja2V0IjoxMjA5NjAwLCJ2ZXJzaW9uIjpudWxsfSwidGZ3X3Nob3dfYmlyZHdhdGNoX3Bpdm90c19lbmFibGVkIjp7ImJ1Y2tldCI6Im9uIiwidmVyc2lvbiI6bnVsbH0sInRmd19kdXBsaWNhdGVfc2NyaWJlc190b19zZXR0aW5ncyI6eyJidWNrZXQiOiJvbiIsInZlcnNpb24iOm51bGx9LCJ0ZndfdXNlX3Byb2ZpbGVfaW1hZ2Vfc2hhcGVfZW5hYmxlZCI6eyJidWNrZXQiOiJvbiIsInZlcnNpb24iOm51bGx9LCJ0ZndfdmlkZW9faGxzX2R5bmFtaWNfbWFuaWZlc3RzXzE1MDgyIjp7ImJ1Y2tldCI6InRydWVfYml0cmF0ZSIsInZlcnNpb24iOm51bGx9LCJ0ZndfbGVnYWN5X3RpbWVsaW5lX3N1bnNldCI6eyJidWNrZXQiOnRydWUsInZlcnNpb24iOm51bGx9LCJ0ZndfdHdlZXRfZWRpdF9mcm9udGVuZCI6eyJidWNrZXQiOiJvbiIsInZlcnNpb24iOm51bGx9fQ%3D%3D&frame=false&hideCard=false&hideThread=false&id=1950172160158245027&lang=en&origin=https%3A%2F%2Fcointelegraph.com%2Fnews%2Fcrypto-stocks-tumble-alongside-btc-equities-as-tariff-fears-resurface&sessionId=d2c962e63c0b389d2538ef5244a5de6a6f71919c&siteScreenName=cointelegraph&theme=light&widgetsVersion=2615f7e52b7e0%3A1702314776716&width=550px

According to Elfarra, Tron has an early mover advantage as a blockchain launched back in 2017. However, the real momentum, he said, came from building relationships and infrastructure around the world, particularly in partnership with major centralized exchanges like Binance and OKX. These collaborations allowed users in underbanked regions to finally access financial services. Tron became an easy and efficient gateway into crypto for many.

Tron powers a wide array of payment tools, from debit cards and orchestration layers to B2P APIs that allow businesses to accept crypto in any local currency they choose. The result is a global PayFi ecosystem that’s becoming increasingly native to Tron.

One of the standout innovations of 2025 so far has been the rollout of gas-free USDT transfers by Tron. Elfarra explained that the new feature isn’t about replacing the network’s native token, TRX, but abstracting it away to improve user experience. “Users no longer need to hold TRX to pay gas. With just 1 USDT in a wallet, you can now send and receive transfers. Behind the scenes, it still uses energy from the TRX staking model — $1 in, $1 out. It’s a simple solution that lowers the barrier to entry and makes crypto more usable at scale.”

Meanwhile, TRX’s utility hasn’t diminished. “The abstraction makes TRX more essential. It powers the system in the background, and developers or power users still need to engage with the staking and energy mechanics,” Elfarra said.

Touching on USDD, Tron’s native algorithmic stablecoin, the spokesperson confirmed that the token had fully transitioned to a decentralized minting process. “The old contract was retired, and the new one ensures smart contract-based minting. It’s not something we promote in all jurisdictions due to regulatory constraints, but it’s a significant step toward stablecoin decentralization.”

Partnerships have also been key to Tron’s 2025 strategy. Sam Elfarra highlighted a wave of recent collaborations, including validator and analytics platforms like Nansen, Kiln and P2P.org, as well as Chainlink, which became Tron’s official oracle provider. Payment infrastructure players like MoonPay, Mercuryo and Revolut Pay also came onboard, further expanding Tron’s fiat on-ramp and off-ramp capacity.

Elfarra highlighted the contribution of these partnerships to the ecosystem, saying, “These are high-throughput infrastructure teams – people building core services, providing liquidity and driving developer tooling that makes Tron more accessible and reliable.”

The spokesperson also emphasized Tron’s reliability, scalability and affordability: “We check all the boxes: fast finality, decentralization, developer-friendly, cheap fees. And most importantly, we don’t go down. Uptime matters when you’re building for global users.”

Contrary to the widespread approach of doubling down on DeFi, Tron centers its efforts around PayFi. “DeFi is still there, but PayFi is where we’re seeing the most growth,” Elfarra said. “Payment companies from Latin America to Africa are choosing USDT on Tron because of the strong liquidity, fast settlement and deep exchange integration.”

Looking ahead, Tron aims to bring more real-world assets onchain, while simultaneously expanding PayFi and DeFi platforms to make those assets usable. The strategy also includes targeted campaigns to attract both developers and users, alongside a strong push to enhance the network’s underlying infrastructure.

Sam Elfarra also noted that Tron is investing heavily in its community through on-the-ground events, developer grants and incentive programs. “We have a Builders League, an energy subsidy program and we’re always open to funding strong projects through custom grants. Just reach out. DM me, join Tron DAO on Telegram or submit through the public grant form. We want to support builders who bring real utility to the network.”

The spokesperson confirmed that Tron is actively working to expand fiat ramps across Latin America and Africa. “We’re in ongoing talks with more local providers and continue to scale access region by region.”

The session wrapped with a look at Tron’s broader mission. Elfarra emphasized that “Tron is becoming the infrastructure layer for global crypto payments.” And in a world where fast, and borderless payments are a necessity, that might be an important role.