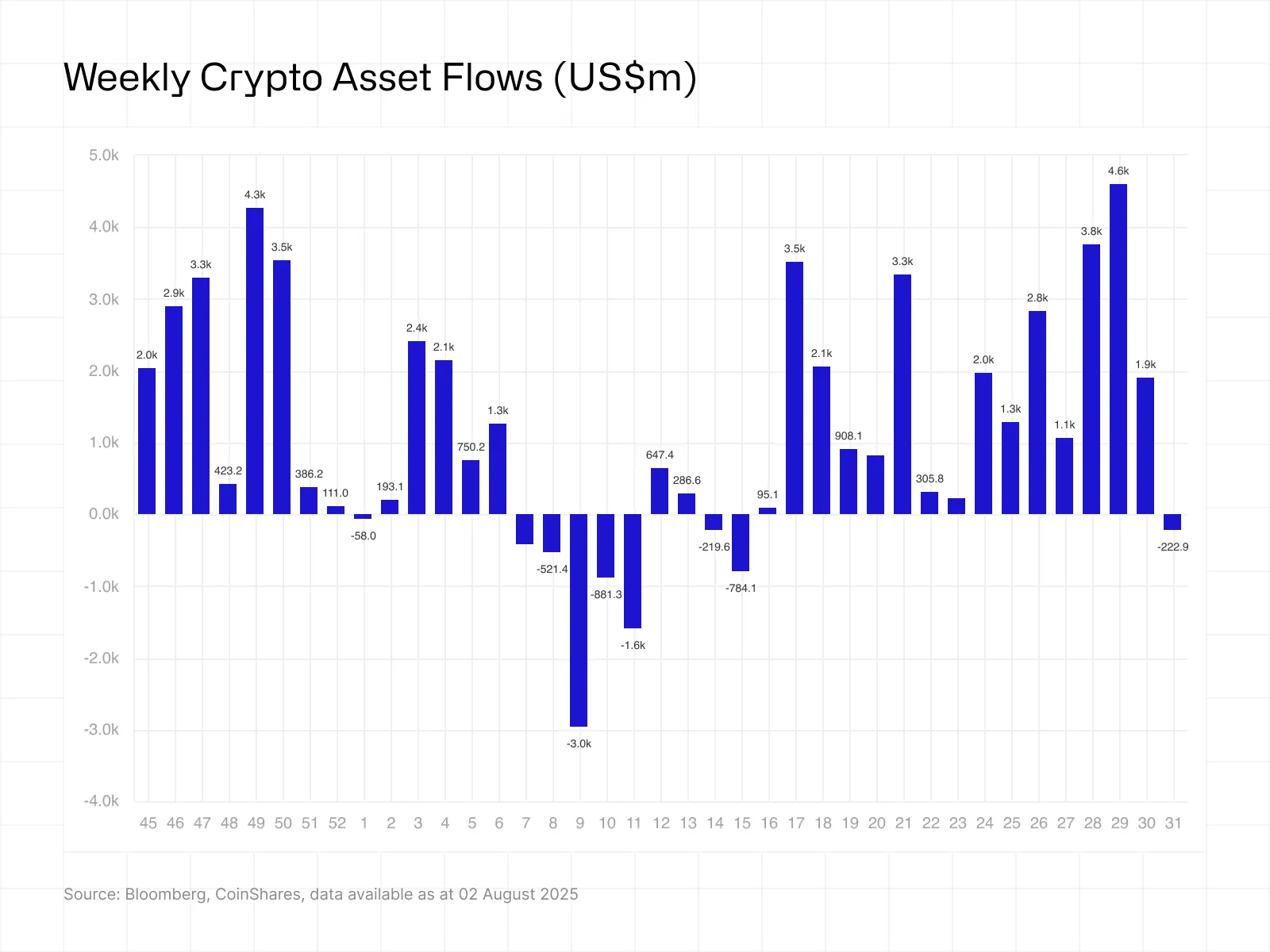

Profit-taking broke a 15-week winning streak of global cryptocurrency ETPs last week after hawkish remarks that followed last week’s US Fed rate decision.Listen3:51

Cryptocurrency investment products ended last week in the red, interrupting 15 weeks of consecutive inflows after investor sentiment took a hit from hawkish remarks during last week’s Federal Open Market Committee (FOMC) meeting.

Global crypto exchange-traded products (ETPs) saw $223 million worth of outflows last week, according to the latest report from crypto asset management firm CoinShares, published Monday.

Despite a strong start to the week with $883 million worth of inflows, the “trend reversed” in the second half of the week, “likely triggered by the hawkish FOMC meeting and a series of better-than-expected economic data from the US,” the report said, adding:

“Given we have seen US$12.2bn net inflows over the last 30 days, representing 50% of inflows for the year so far, it is perhaps understandable to see what we believe to be minor profit taking.”

US Federal Reserve Chair Jerome Powell’s remarks also dampened investor expectations of an interest rate cut for September to 40% from 63% before the FOMC meeting, Cointelegraph reported last Thursday.

The decline in sentiment comes as Bitcoin

BTC$114,444 enters August, historically one of its worst-performing months. Data from CoinGlass shows Bitcoin’s median return in August stands at -7.49%.

One app, all things crypto — buy, trade, earn, and manage it all with Uphold. Capital at risk. Terms Apply.Ad

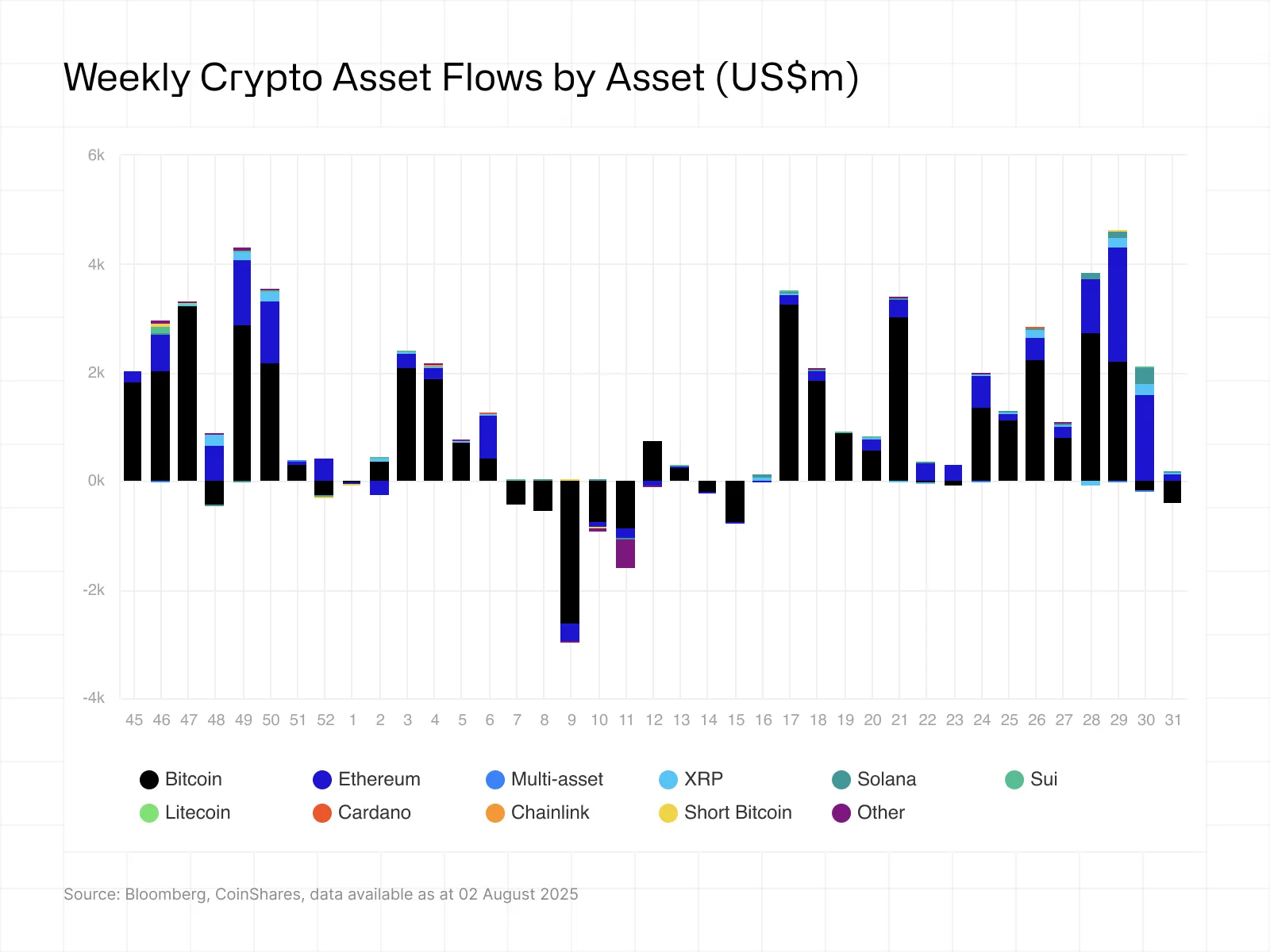

Bitcoin products accounted for the bulk of last week’s losses, with $404 million in outflows. Despite the pullback, some analysts said Bitcoin’s next catalyst may arrive after the summer recess. In a research note published Friday, Matrixport said Bitcoin could gain traction when the US Congress reconvenes after Labor Day.

“Fiscal uncertainty has historically been a powerful tailwind for hard assets, and Bitcoin remains front and center in the narrative,” the report said.

Related: Bitcoin becomes 5th global asset ahead of “Crypto Week,” flips Amazon: Finance Redefined

Ether defies broader fund retreat

Despite outflows among global cryptocurrency funds, Ether

ETH$3,665 ETPs closed their 15th week of net positive inflows, attracting $133 million of investments despite a pullback in the second half of the week.

The report attributed the continuous Ether fund inflows to “robust positive sentiment for the asset.”

Crypto funds focused on XRP

SUI$3.51 also closed the week in the green, seeing $31.2 million, $8.8 million and $5.8 million in inflows, respectively.

Related: Ethereum at 10: The top corporate ETH holders as Wall Street eyes crypto

On Thursday, US President Donald Trump signed an executive order imposing reciprocal import tariffs of 15% to 41% on goods from 68 countries, effective Thursday, Aug. 7.

Despite Trump’s tariff order sending a “chill through global markets,” cryptocurrency markets saw a “recalibration” rather than a breakdown, said Stella Zlatareva, dispatch editor at digital asset investment platform Nexo.

“The digital asset market remains firmly above $3.7 trillion, anchored by structural flows, institutional conviction and the promise of clear US regulation,” she told Cointelegraph, adding that “altcoin stability may gradually return.”