Bitcoin and Ether could fall back toward the $100,000 and $3,000 level amid concerns of more tariffs, a sluggish credit market and slowed job creation, Arthur Hayes argues.

Maelstrom Fund chief investment officer Arthur Hayes has warned that mounting macroeconomic pressures could drag Bitcoin back down to the $100,000 level — and he’s already taken crypto profits in anticipation.

Hayes linked the recent crypto pullback to renewed tariff fears sparked by the disappointing Non-Farm Payrolls report, which showed just 73,000 new jobs added in the US in July — a sign of economic fragility.

Hayes also pointed to sluggish credit growth in major economies stunting nominal gross domestic product growth in warning that Bitcoin

ETH$3,679 could fall further toward the $100,000 and $3,000 levels.

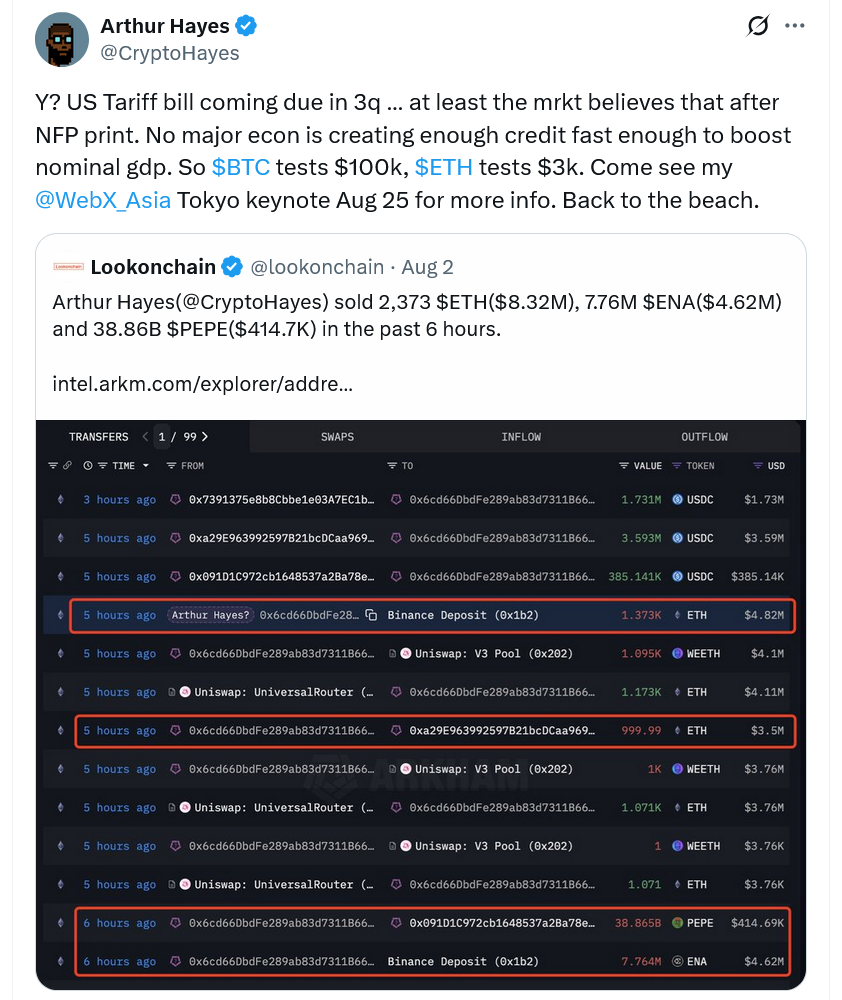

Hayes sold over $13M of ETH, ENA and PEPE

His comments on Saturday came in response to an X post from blockchain analytics platform Lookonchain, which highlighted that Hayes recently offloaded $8.32 million worth of ETH, $4.62 million of Ethena

ENA$0.5977 and $414,700 of the Pepe

PEPE$0.00001064 memecoin.

One app, all things crypto — buy, trade, earn, and manage it all with Uphold. Capital at risk. Terms Apply.Ad

The Hayes’ wallet that carried out the recent selloffs now holds $28.3 million worth of tokens, with $22.95 million parked in the USDC

USDC$0.9998 stablecoin, according to Arkham Intelligence data.

Bitcoin on the verge of a double digit correction

Hayes’ comments echo wider fears that macro headwinds could stall crypto’s momentum. Tight credit, renewed tariffs and a softening job market may pressure risk-on assets, testing investor conviction and potentially triggering a correction.

Bitcoin has fallen over 7.7% from the $123,000 all-time high it set on July 14, while Ether is down 12.5% since eclipsing the $3,900 barrier on July 28, CoinGecko data shows.

A Bitcoin price drop to $100,000 would mark an 18.7% correction.

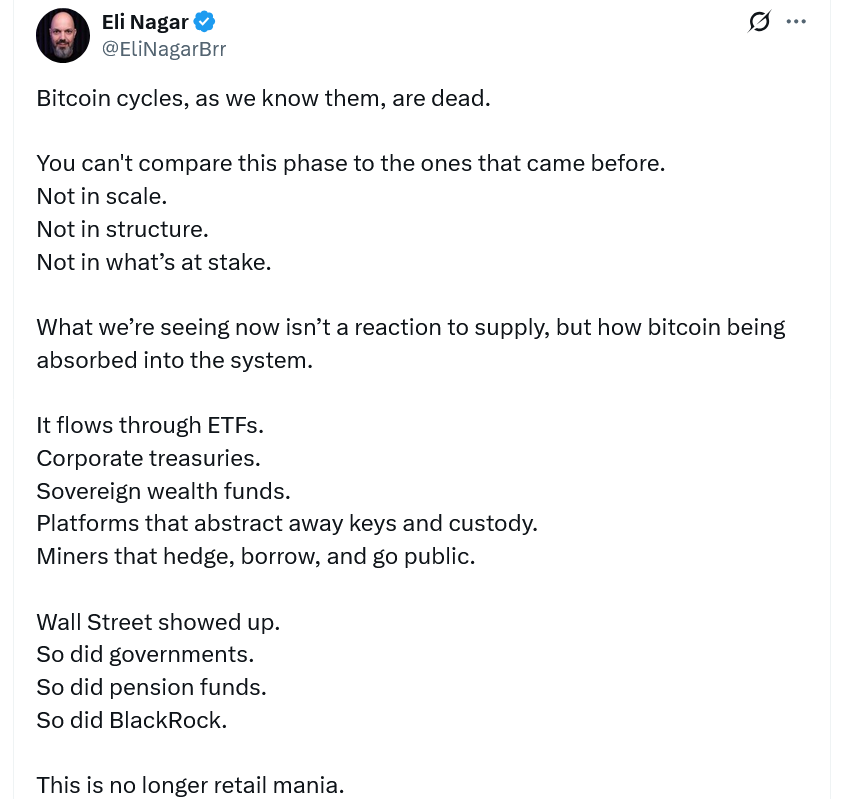

Bitcoiners say it’s different this time

However, many industry analysts think Bitcoin is past the days of major double-digit pullbacks.

Among them is Bloomberg ETF analyst Eric Balchunas, who noted that since BlackRock’s spot Bitcoin ETF filing in June 2023, Bitcoin has experienced “much less volatility and no vomit-inducing drawdowns.”

Related: Ray Dalio sells final Bridgewater stake after predicting debt collapse

Mitchell Askew, head analyst of Bitcoin mining firm Blockware Solutions added: “The days of parabolic bull markets and devastating bear markets are over.”

Magazine: Crypto traders ‘fool themselves’ with price predictions: Peter Brandt