XRP may be gearing up for a short-term rebound, crypto companies are beginning to return to the United States, and other news.Listen

Top Stories of The Week

SEC Chair Aktins calls to ‘reshore crypto’ as companies move back to the US

Crypto companies are beginning to return to the United States as top officials signal a shift toward friendlier regulation and domestic growth.

In a Thursday speech at the America First Policy Institute, SEC Chair Paul Atkins called on the country to “reshore the crypto businesses that fled,” reinforcing a broader effort by the administration of President Donald Trump to position the US as a global hub for digital assets.

Treasury Secretary Scott Bessent said on Friday that the US has entered the “golden age of crypto” and issued a direct call to builders: “Start your companies here. Launch your protocols here. And hire your workers here.”

Backed by clearer regulations and high-level political support, crypto companies are beginning to respond, with some relocating operations to the US from abroad, and others, like Kraken and MoonPay, expanding their domestic footprint in response to the policy shift.

US SEC rolls out ‘Project Crypto’ to rewrite rules for digital assets

US SEC Chair Paul Atkins has announced “Project Crypto,” an initiative to modernize the agency for the digital finance age and establish clear regulations for digital assets in the United States.

Atkins said Project Crypto was in direct response to recommendations in a recent report by the President’s Working Group on Digital Asset Markets.

Atkins proposed easing licensing rules to allow for multiple asset classes or instruments to be offered by brokerages under a single license, while also creating a clear market structure separating commodities, which most cryptocurrencies fall under, from securities.

Regulatory exemptions or grace periods should be afforded to early-stage crypto projects, initial coin offerings, and decentralized software to allow these projects enough room to innovate, without crushing them under the weight of litigation or fear of reprisal by the SEC, Atkins said.

99% of CFOs plan to use crypto long term, 23% within two years: Deloitte

Cryptocurrency is becoming a financial planning priority, with 99% of chief financial officers at billion-dollar firms expecting to use it for business in the long term, according to Deloitte’s Q2 2025 survey of CFOs.

The survey, conducted among 200 CFOs at companies with over $1 billion in revenue, revealed that 23% expect their treasury departments to use crypto for investments or payments within the next two years. This figure climbs to almost 40% among CFOs at firms with revenue of more than $10 billion.

Despite the momentum, finance chiefs remain cautious. Concerns about price volatility top the list, with 43% of respondents citing it as a primary barrier to adopting non-stable cryptocurrencies like Bitcoin and Ether.

Other major concerns include accounting complexity (42%) and regulatory uncertainty (40%), the latter of which has been compounded by shifting US policy.

UK regulator lifts ban on crypto ETNs for retail investors

The United Kingdom’s Financial Conduct Authority (FCA) has lifted the ban on retail access to cryptocurrency exchange-traded notes (cETNs).

Companies in the UK will soon be able to offer retail consumers cETNs, with regulatory changes effective Oct. 8, according to an FCA announcement on Friday.

The new development in the UK’s regulatory approach on crypto comes after the FCA banned crypto ETNs in January 2021, citing the extreme volatility of crypto assets and a “lack of legitimate investment need” for retail consumers.

“Since we restricted retail access to cETNs, the market has evolved, and products have become more mainstream and better understood,” David Geale, FCA executive director of payments and digital finance, said in the announcement.

CoinDCX employee arrested in connection with $44M crypto hack: Report

An employee of CoinDCX, a cryptocurrency exchange that was hacked for $44 million in mid-July, was arrested in India in connection with a security breach, according to multiple local reports.

Bengaluru City police detained CoinDCX software engineer Rahul Agarwal after hackers allegedly managed to compromise his login credentials to siphon the exchange’s assets, The Times of India reported on Thursday.

The arrest followed a complaint and internal investigation by CoinDCX operator Neblio Technologies, which determined that Agarwal’s credentials had been compromised via his work laptop, allowing unauthorized access to the company’s servers.

One app, all things crypto — buy, trade, earn, and manage it all with Uphold. Capital at risk. Terms Apply.Ad

During questioning as his laptop was seized, Agarwal, 30, denied involvement in the crypto theft, but admitted to taking on part-time work for up to four private clients while still employed at CoinDCX.

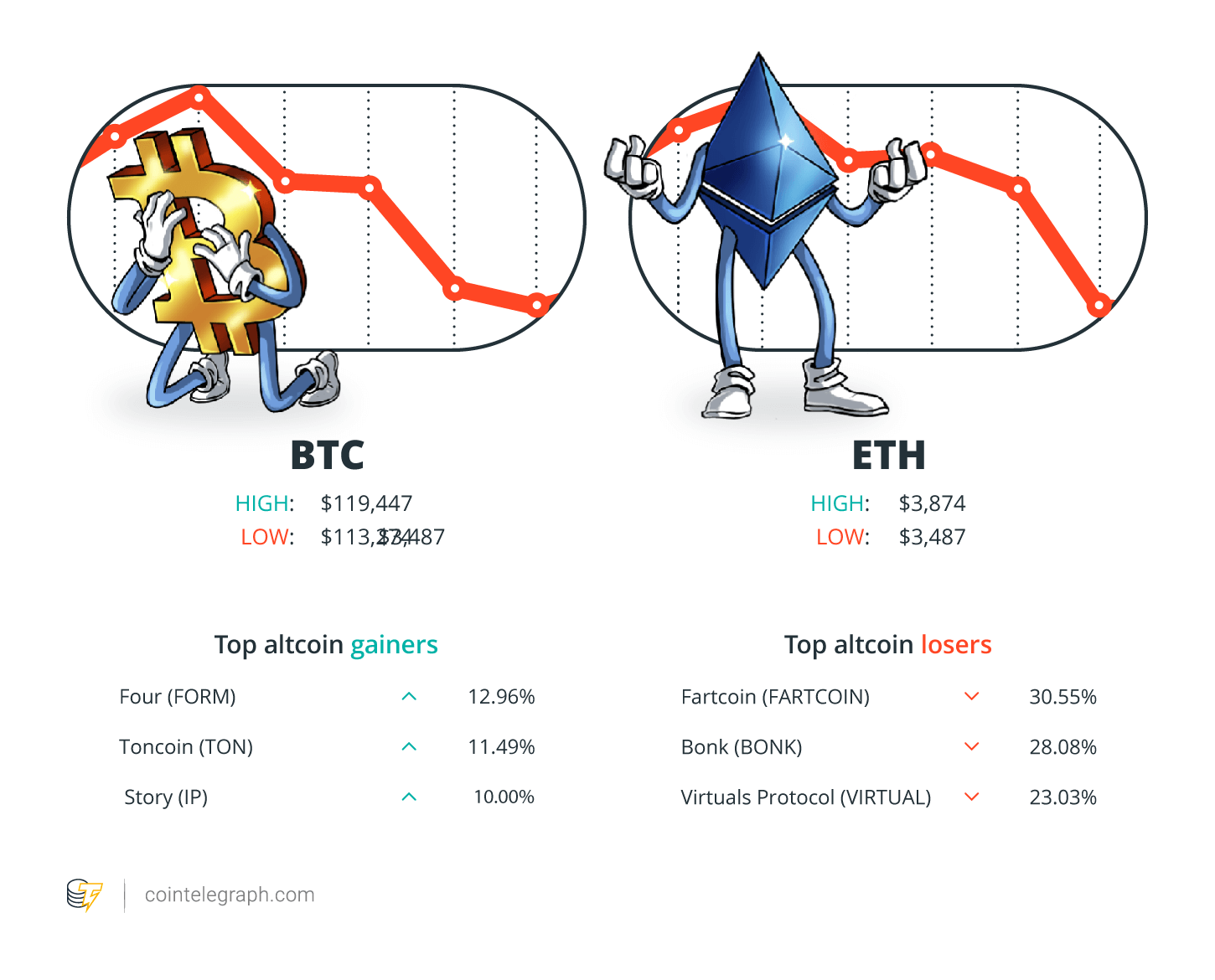

Winners and Losers

At the end of the week, Bitcoin

BTC$114,671 is at $113,936, Ether

XRP$3.05 at $3.01. The total market cap is at $3.71 trillion, according to CoinMarketCap.

Among the biggest 100 cryptocurrencies, the top three altcoin gainers of the week are Four (FORM) at 12.96%, Toncoin (TON) at 11.49% and Story (IP) at 10.00%.

The top three altcoin losers of the week are Fartcoin (FARTCOIN) at 30.55%, Bonk (BONK) at 28.08% and Virtuals Protocol (VIRTUAL) at 23.03%. For more info on crypto prices, make sure to read Cointelegraph’s market analysis.