Ethereum’s 10th anniversary celebration was marked by an uptick in institutional demand for Ether as an alternative treasury reserve asset, prompting Wall Street to look past Bitcoin.

Ethereum’s 10th anniversary was marked by a significant milestone in terms of institutional crypto adoption, as cryptocurrency treasury firms surpassed $100 billion in collective investments on Thursday.

Ethereum’s 10th birthday brought renewed corporate interest in Ether

ETH$3,699, which saw the 10 largest corporate crypto treasury firms amass over 1% of the total Ether supply since the beginning of June, according to a Tuesday report by Standard Chartered.

The bank predicted that corporations will eventually hold 10% of the total Ether supply, which may see the world’s second-largest cryptocurrency surpass the bank’s year-end target price of $4,000 per Ether.

Ether’s corporate adoption is “happening faster than with Bitcoin during its early treasury adoption phase,” since Ether enables corporations to tap into staking yields and “actively generate value,” Enmanuel Cardozo, market analyst at Brickken asset tokenization platform, told Cointelegraph.

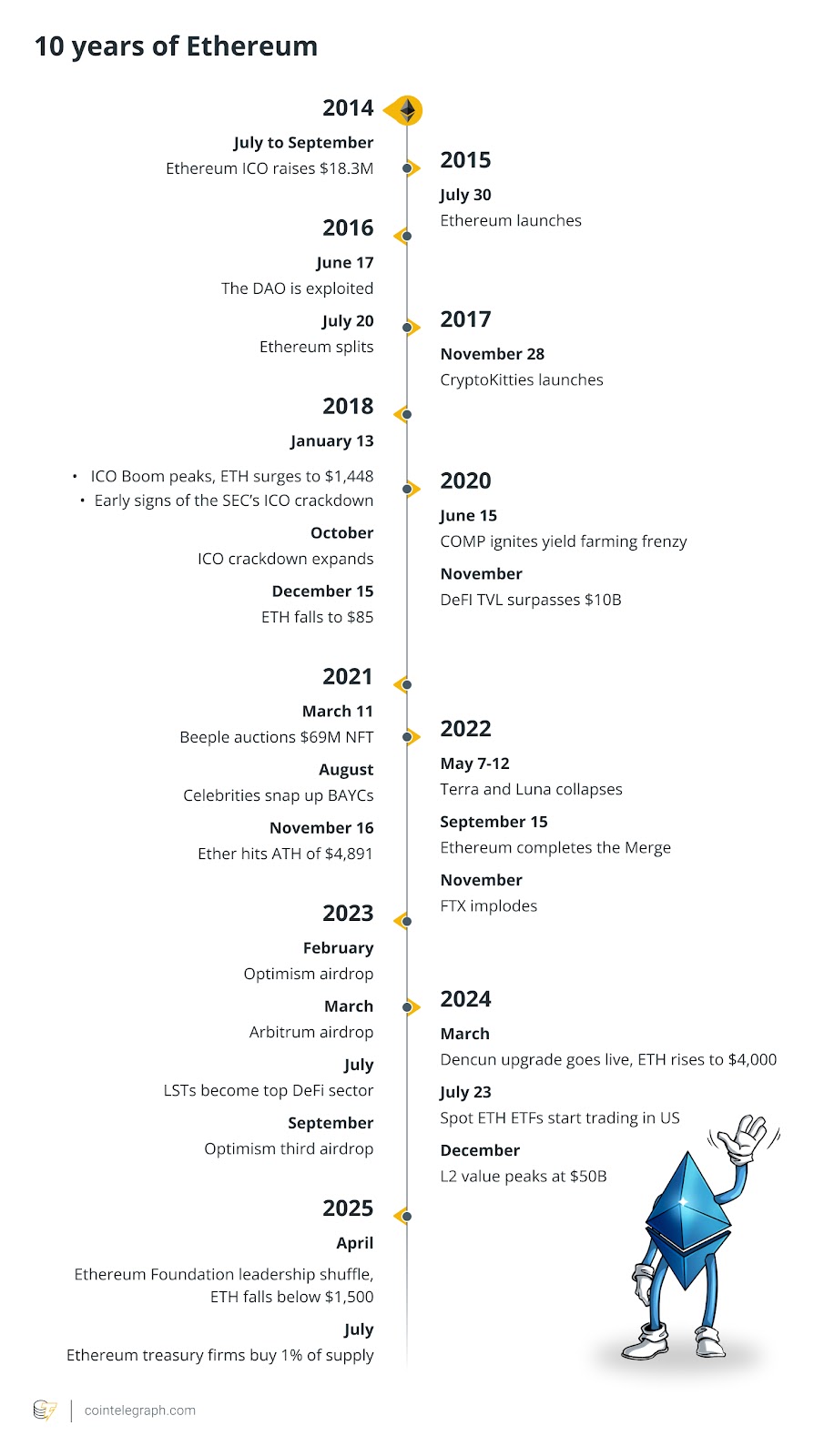

Ethereum turns 10: Here’s how its booms and busts shaped history

Ethereum celebrated its 10-year anniversary on Wednesday, with renewed institutional momentum fueling hopes that Ether

ETH$3,699 could challenge its all-time high set in November 2021.

Over the past decade, Ethereum has become the largest decentralized finance (DeFi) blockchain, with nearly $85 billion in total value locked (TVL) at the time of writing.

Vitalik Buterin, Ethereum’s co-founder, circulated an early version of the white paper in 2013. The project raised $18.3 million in its initial coin offering (ICO) and officially launched in 2015 as a blockchain for smart contracts. Its cryptocurrency, Ether, now ranks as the second-largest cryptocurrency by market capitalization after Bitcoin

Here’s a look back into Ethereum’s first decade, featuring the ICO boom, DeFi summer and the rise and fall of non-fungible tokens (NFTs).

Corporate crypto treasury holdings top $100 billion as Ether buying accelerates

Corporate cryptocurrency treasuries are emerging as a new class of public companies bridging traditional finance and digital assets, signaling increasing institutional interest in crypto.

Corporate cryptocurrency treasury firms, including Strategy, Metaplanet and SharpLink, have collectively amassed about $100 billion worth of digital assets, according to a Galaxy Research report released Thursday.

Bitcoin

BTC$114,898 treasury firms hold the lion’s share, with over 791,662 BTC worth about $93 billion on their books, representing 3.98% of the circulating supply. Ether

ETH$3,699 treasury firms hold 1.3 million ETH tokens, worth more than $4 billion, representing 1.09% of the Ether supply, the report said.

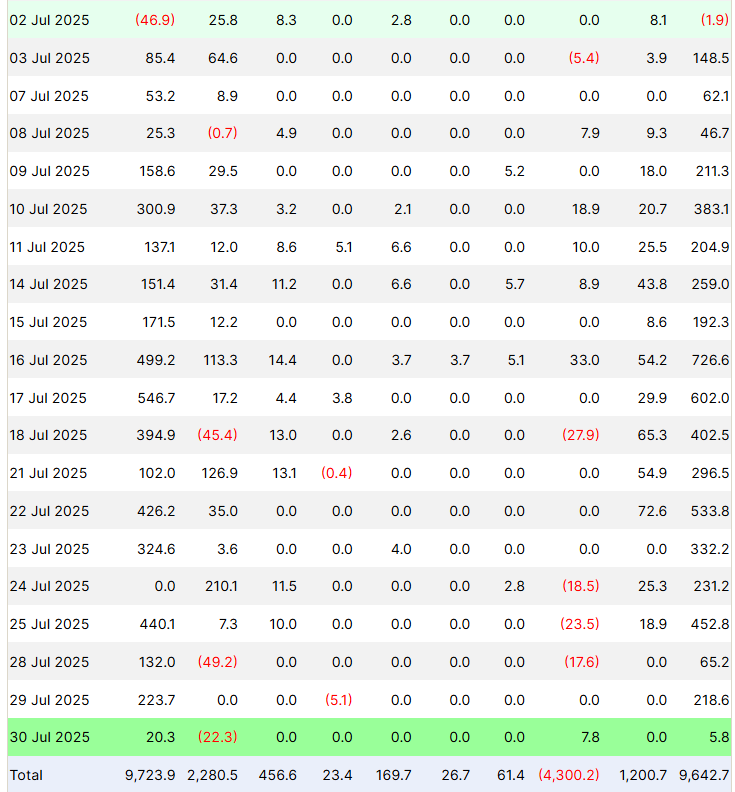

Corporate buyers are becoming a key source of Ether liquidity alongside US spot ETH exchange-traded funds, which recently posted 19 consecutive days of net inflows, a record for the products.

Since July 3, the Ether ETFs amassed $5.3 billion worth of ETH as part of their record winning streak, Farside Investors data shows.

More corporate buying and continued ETF inflows may help Ether surpass the $4,000 psychological mark, which is also the year-end price target of Standard Chartered, the bank said in a Tuesday research report.

“We think they may eventually end up owning 10% of all ETH, a 10x increase from current holdings,” the bank said, adding that Ether treasury firms have more growth potential than Bitcoin treasuries, from a “regulatory arbitrage perspective.”